— by Datuk Ir. Ahmad ‘Asri Abdul Hamid, Ahmad Farrin Mokhtar and Che Saliza Che Soh

The Malaysian construction industry is a key economic engine for the overall economy. It forms a significant component of the Malaysian Gross Domestic Product (GDP), registered an annual growth rate of 7.9% from 2010 to 2016. Presently the construction industry contributes 4% to the GDP. The industry demonstrates a strong correlation with economic development, with the construction share of GDP positively correlated with GDP per capita.

The construction industry is not limited to the construction of buildings as misconstrued by some. It involves the building of many structures such as social amenities, railways, oil and gas facilities, power plants, roads, highways, and bridges to name a few. The industry has a 2.03 multiplier effect, supporting around 196 industries and consuming 15% of the total manufacturing output. It provides great support to the economy by having strong forward and backward linkages with other sectors of the economy mainly in manufacturing, services, agriculture, and also mining and quarrying.

Given its size, the industry is a large consumer of both goods and services, particularly in the manufacturing sector, including significant quantities of basic metals, ceramics, cement, and other building materials. CIDB has to this date registered 330 manufacturers of which 39% are steel manufacturers, 16% are ready-mixed concrete producers, 14% are precast concrete suppliers, 9% are glass distributors, 6% are cement suppliers, and 16% consist of other types of materials. The construction industry is also a large consumer of higher value-added equipment and machinery. Furthermore, it is also a key consumer for knowledge-driven consultancy and engineering. In total, 4,670 professional firms are registered with their respective Professional Boards of which 56% are engineering firms, 36% are architectural firms and the remaining 8% are quantity surveying firms.

The construction industry also presents significant employment opportunities. It is Malaysia’s fourth-largest employer, employing approximately 1.28 million registered workers, representing 8% of the total national workforce distribution. Almost 75% of the registered employees in the construction industry are Malaysians. The local workforce contributes to many crucial areas of the organization, predominantly administration, project management, and skilled personnel services.

To date, the total number of construction companies registered with CIDB is 123,419 companies. Out of this, G1 contractors are the largest group with 60,240 companies, representing 49% of the total number of registered contractors. This is then followed by the G2 to G4 contractors which represent 37%, 7% by the G5 & G6 contractors, while the G7 contractors form the remaining 7%. This indicates that the construction industry is dominated by small and medium enterprises (SMEs) compared to larger corporations.

Since the construction industry is relatively correlated with the nation’s manufacturing and services sectors, there is major involvement of SMEs in this industry. In general, SMEs are defined as small to medium-sized companies with no more than 50 full-time employees and with an annual sales turnover not exceeding RM5 million. For CIDB, the SMEs are categorised according to the size of the company’s capital and project value not exceeding RM5 million. G1-graded companies are those with the smallest capital size and project value while G5-graded companies are those with the largest capital and project value. SMEs occupy 89% of the construction industry and are involved in many activities in the value chain of construction.

Situational Analysis

The construction volume is large but has been on the declining trend even before the Movement Control Order (MCO) was enforced on 18 March 2020. The value of projects awarded in 2016 was RM241 Billion whereas the value in 2017 was reduced to RM163 Billion. The same trend followed with only RM140 Billion worth of projects recorded in 2018, RM102 Billion projects in 2019, and only RM13 Billion projects reported in 2020 up to March. Based on these statistics, it is clear that the value of works for the construction industry has continuously declined since 2016.

The decline was been made worse due to the enforced MCO as a result of the pandemic situation. The value of projects implemented in December 2019 was RM9 billion but was reduced to RM7 billion by January 2020, a 20% reduction compared to the month before. In March 2020, the value of projects was at RM2 billion compared to RM4 billion in February 2020, which was a 50% reduction in the value of projects implemented. The huge reduction is the result of the enforced MCO where up to 90% of construction projects were not allowed to operate as well as a number of new projects cannot be physically implemented on site.

The enforced MCO has resulted in the construction industry suffering an estimated loss of RM11.0 billion per month due to the halting of 7,500 ongoing projects. Thirty percent of the losses were due to unpaid wages amounting to RM3.3 billion, 42% of unused materials amounting to RM4.6 billion, 12% of idling plants and equipment amounting to RM1.3 billion, 8% of head office overhead amounting to RM0.9 billion as well losses on profit at 8% amounting to RM 0.9 billion.

The huge losses suffered by the industry will have a negative impact on the economy if no containment measures are implemented. In view of this, the Government decided that a few of the construction works can be allowed to continue to operate to mitigate the losses as well as to partly rejuvenate the economy with the following considerations:

i. Safeguarding the safety of the public;

ii. Limiting the number of workers at construction sites;

iii. Ensuring works to be opened in stages so that there will not be a surge in demand for resources (i.e., materials and workers).

Based on the announcement made on 10 April 2020 by YB Datuk Seri Azmin Haji Ali, the Senior Minister for Trade and Industry, the following are the type of works that are allowed to operate during the MCO:

i. Works under G1 and G2 as main contractors;

ii. Ensure nice alignment of the numbered list

iii. Tunnelling;

iv. Maintenance;

v. Slope Works;

vi. Bridges and Viaducts;

vii. Soil Investigation;

viii. Building Projects with 70 IBS Score;

ix. Projects that are equipped with workers accommodation facilities such as Centralised Labour Quarters (CLQ) or Workers Camp;

x. Emergency Works as stipulated in the contract;

xi. Maintenance and cleaning work to avoid mosquitoes and pests;

xii. Works that might endanger the public if not continued;

xiii. All professional services inclusive of (but are not limited to) Architectural, Engineering, Town Planning, Land Surveying, Quantity Surveying, Project Management, Facilities Management, etc.

The opening up of these works in stages has vast consequences on the construction industry. It is estimated that RM.4.4 billion worth of projects will be involved and this, in turn, will help to reduce the losses of the industry to RM6.6 billion. Such a huge impact will indeed bring positive growth to the economy at large.

Mitigation Strategy

For the construction industry to survive, sustain and rebound from this pandemic event, several mitigation strategies are required to be implemented urgently. Resources such as workers and materials as well issues on cash flow and contracts need to be addressed immediately. Several key components have been identified to assist and support the construction-related companies in this challenging economic environment such as:

i. Cash Flow Issue

a. Maintaining current credit facilities offered by banks so as not to affect the construction-related company’s balance sheet and cash flow. It will give the companies some breathing space to operate during this trying time and help to partly solve their cash flow issue.

b. The government can lend its hand to ease the cash flow problems faced by construction-related companies by reducing, waiving or deferring statutory fees charged to projects. The statutory fees charged to a project are usually about 10% of the development cost. Such a huge amount will indeed be a great relief to construction-related companies in particular developers if the proposal to reduce, waive or defer the statutory fees is accepted by the government.

c. Banks to provide additional bridging loans especially to developers at a low-interest rate so that the developers will have extra funds to finance their projects.

d. The government should consider the exemption of digital tax and provide more incentives to companies that migrate to digital solutions to overcome the reliance on foreign labor and reduce the migration costs to digital solutions.

e. The government, as well as private clients, need to expedite any payment due to ease the cash flow problem currently faced not only by contractors but also by consultants and suppliers.

f. The government should also consider releasing the retention fund in projects immediately upon full compliance by contractors.

ii. Contractual Issue

a. There is a need for the government to intervene and assist in the Extension of Time (EOT) issue for projects affected by the MCO. Many contractors, as well as developers, may face litigation due to delays in projects as a result of the MCO. This might give rise to millions of losses to the industry.

iii. Materials and Labour Issues

a. All projects, whether new or existing, need to be implemented in stages or phases so that there will not be a surge in demand for materials and workers.

b. The government must also take steps to prevent certain companies from monopolising the supply of materials and implement mechanisms to control the price of materials.

c. It is crucial for companies to retain their workers during this pandemic situation. The government needs to provide support in reducing the overhead costs by providing higher subsidies for wages, thus allowing companies to retain their workers.

d. Retaining the workers will allow the companies to operate at a normal pace once the MCO is lifted.

iv. Housing Sector Issues

a. The housing sector plays an important part in the economy. Hence, there is a need to rejuvenate the housing sector to boost the economy:

b. Lembaga Pembiayaan Perumahan Sektor Awam (LPPSA) must be allowed to operate during the MCO so that housing loans can be processed and disbursed. This will indeed help the small-time developers in particular, as they are dependent on such loan disbursements to finance their projects.

c. The launch Home Ownership Campaign (HOC) for 2020 with the same benefits granted in HOC 2019 to be retained including the minimum 10% discount from developers to encourage more people to take up home ownership.

d. The Real Property Gain Tax (RPGT) to be exempted if the property is disposed of on the 6th year onwards as this move will boost the housing sector by strengthening demand.

e. Extending the loan repayment period up to 40 years or age 70, whichever is shorter, at reasonable interest rates for houses priced RM300,000 and above. The longer loan period will lessen the buyers’ burden as it gives an opportunity for a higher margin of financing and lower monthly repayment amount.

f. The interest for housing loan on houses priced RM500,000 and below to be kept at 3.5%.

g. Allowing the reinstatement of Developers’ Interest-Bearing Scheme (DIBS) whereby the developers will include the interest of the housing loan disbursed during the construction period in the house price.

h. Removal of Loan to Value (LTV) ratio for housing loans of the property onwards as this will help to spur the growth and demand for housing.

Immediate Reform Measures

The difficulties faced by the construction industry now due to the MCO are unprecedented and will continue even after the MCO is lifted. Immediate measures to be put in place to help the construction industry rebound are as follows:

i. The need to adopt digital construction, such as Building Information Modelling (BIM), to make the industry more efficient and resilient in facing economic difficulties, which in return will lead to the reduction of foreign workers.

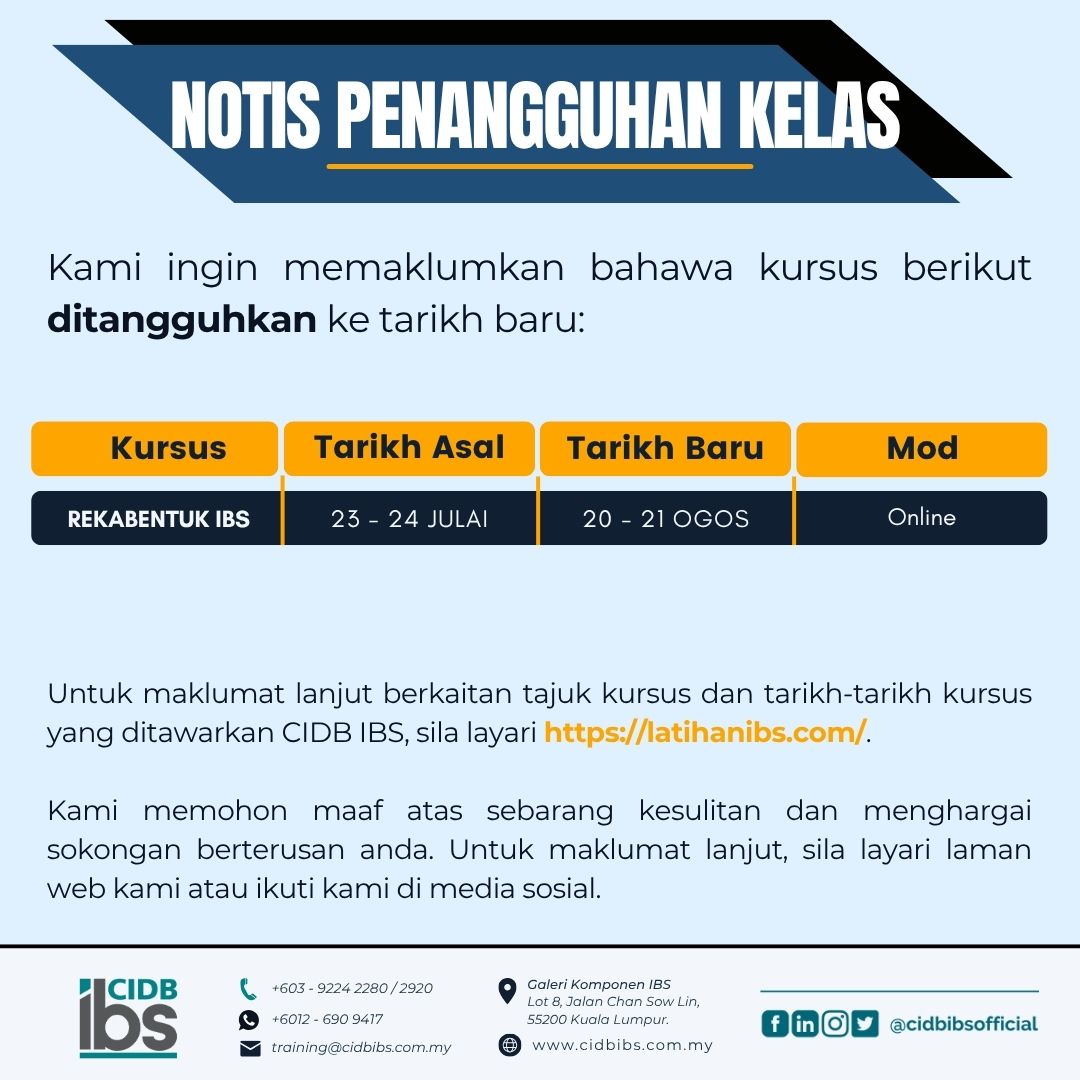

ii. Increase the use of the Industrialised Building System (IBS) in the Malaysian construction industry. IBS has been shown to improve construction sustainability. However, there have been some challenges in implementing this scheme, such as standardisation, team disintegration, and a lack of expertise and knowledge on IBS. Modular coordination must be incorporated to resolve these obstacles. As a result, components will be used more efficiently, and consultants will be encouraged to produce more user-friendly designs. Furthermore, increasing the usage of IBS would result in more sustainable construction, higher productivity, and more efficient resource use.

iii. The necessity to enforce policy on the use of local resources especially in government projects. Projects that rely on imported products are facing problems

iv. as the products are produced in pandemic-affected countries and can take between 6 to 8 months to be delivered compared to only 1 to 2 months previously.

v. It is crucial for the government to focus more on facilities management by allocating more budget for maintenance, especially road maintenance. It is also recommended that a portion of the road tax and car insurance payments be utilised for road maintenance.

vi. Public projects that have been planned before or are already in the pipeline need to be executed immediately. The government should consider implementing new procurement systems such as the fast-track method or using the preapproved plan (PAP) by JKR, which can expedite the design process, thus allowing projects to be quickly executed.

vii. Construction is an important sector that contributes greatly to the nation’s economic growth. The construction of buildings and infrastructures represent the fundamental foundations of a strong economy. The move by the Government to implement more projects will stimulate the economy and spur the growth of the country.

viii. The Technical and Vocational Education and Training (TVET) truly needs to be enhanced. The industry’s over-reliance on foreign workers has created a problem, making the industry nonresilient in facing tough economic conditions. To meet industry demand, more highly qualified and capable local workers must be generated via TVET.

ix. A new collaboration initiative between each project partner aided by more web-based project management (PM) systems alongside other tools is needed to enable remote work regardless of the company size. This is because the Malaysian government as well as private clients, contractors, traders, suppliers and consultants are being forced to work together and communicate in a different way now. This initiative should last beyond Covid-19 because the new normal could be a real change to the construction industry as a whole.

Conclusion

The importance of the construction industry to the economy is widely acknowledged. Active construction activities are a clear indicator that the economy is positively growing, while sluggish growth in construction has always been an indicator of a recession. It is therefore important that the construction industry be revived and rejuvenated from the pandemic situation. It is pertinent that the industry transition from being labour-intensive to a capital-intensive sector with a focus on digitalisation to be resilient during difficult times. The construction industry must also rapidly recover to aid Malaysia’s economic development, which necessitates government assistance and intervention. As the private sector is struggling to increase its investment in construction, it would be up to the government to ramp up its investment in public projects. Continued delays in implementing projects, especially public projects, would only delay the construction industry’s recovery as a whole.

References

i. Department of Statistics Malaysia. Statistics from Department of Statistics Malaysia.

ii. Construction Industry Development Board Malaysia. Construction Industry Review and Prospect 2016/ 2017.

iii. Construction Industry Development Board Malaysia. Construction Industry Transformation Programme 2016–2020.

iv. Bank of England. How Does the Housing market Affect the Economy?, https://www.bankofengland. co.uk/knowledgebank/how-does-the-housingmarket- affect-the-economy (retrieved on April 17, 2020)

Resource: HEIGHTS (Apr-Jun 2021)